Part 1

What is an Asset Class Approach?

Is the traditional method of investment allocation limiting investors' understanding of true portfolio risk?

The traditional strategy, sometimes referred to as an "asset class approach" (ACA), establishes a target allocation across asset categories like equities, bonds, hedge funds, and private debt, aiming for positive returns and diversification. This method gained traction in the 1950s when Harry Markowitz introduced Modern Portfolio Theory.

As a result, research, market commentary, and media broadly discuss markets through the lens of asset classes. For practitioners, structuring portfolios by asset class is intuitive, and allows for straightforward allocation analysis and decision-making. However, a reliance just on ACA could stem more from habit and convenience, and may not deliver a deep understanding of risk and diversification.

Part 2

Challenges of an Asset Class Approach

One of the most straightforward examples of asset class allocation is the 60/40 model, comprising 60% equities and 40% bonds. While this approach is intuitive, it also requires careful consideration. For example:

- Diversifying across asset classes does not necessarily equate to diversifying risk. As shown in Exhibit 1 below, global equities and USD-denominated high-yield bonds have had a correlation of 0.70 since 2008, with a correlation as high as 0.92 over a 1-year time frame.1 Illusions of diversification in cases like this can create serious gaps between expected portfolio performance and reality, especially in times of market distress. This raises the question: why target risk diversification from asset classes if we can instead diversify by fundamental risks themselves?

- Investment teams often segment their analysis by individual asset classes, which can lead to misalignment between research and overall portfolio outcomes.

- Additionally, predefining asset class exposure can limit the range of securities available, potentially hindering the achievement of investment goals.

Exhibit 1: Rolling 1-Year Correlation of Global Equities and USD-Denominated High-Yield Bonds

Source: Venn by Two Sigma. Global equities represented by the iShares MSCI ACWI ETF (ACWI). USD-denominated high-yield bonds represented by SPDR Bloomberg High Yield Bond ETF (JNK).

Part 3

What is a Total Portfolio Approach (TPA)?

A TPA moves away from asset classes and labels, and instead considers the fundamental risk factors of the total portfolio. These fundamental risks can be found across and within asset classes. For example, a portfolio might have underlying sensitivities to economic growth, interest rates, or foreign currencies, regardless of the specific assets held. TPA can be used as a single, unified method to assess the risk and return of the entire portfolio, rather than evaluating individual investments separately. Consider this analogy: if an ACA approach is similar to managing a diet via food groups, then the TPA would be more akin to using nutritional labels.

In practice, an equity manager might be compared with a high-yield bond manager to adjust the portfolio's overall exposure to economic growth. Similarly, combining a real estate manager with a government bond manager could fine-tune sensitivity to interest rates.

Part 4

What Opportunities Can a Total Portfolio Approach Unlock?

A TPA naturally dismantles siloed decision-making and research, refocusing on how each position contributes to the portfolio’s exposure to fundamental risks. Reorienting research, market views, and investment decisions back to the total portfolio naturally aligns all stakeholders. This, in turn, can align allocation decisions to total portfolio outcomes, rather than the outcomes of individual asset classes or sleeves.

This approach may also enhance communication, both within teams and externally. Performance and risk reporting through a total portfolio lens can simplify messaging by adopting an outcome-oriented approach. It encourages the use of a common language of risk, rather than varied messaging for different asset classes, managers, or portfolio sleeves.

Moreover, we believe that a TPA can lead to a more precise understanding of risk. By concentrating on independent and fundamental risk drivers across and within asset classes, investors can gain clearer insights into the portfolio's dynamics. This clarity includes identifying the specific contribution of each underlying asset to the total portfolio's risk.

Part 5

Ways to Use a Total Portfolio Approach

A TPA targets exposure to fundamental risks, but how does one measure exposure to these risks? More importantly, how does one determine which fundamental risks to consider in the first place?

The foundation of a TPA is the use of a factor lens, where each factor represents an independent and fundamental market risk. An example of this is the academically researched Two Sigma Factor Lens, a sophisticated turnkey solution for factor-based risk analysis. It is designed to be both practical and comprehensive, using a less-is-more approach to facilitate actionable decision-making.

Exhibit 2: The Two Sigma Factor Lens

Source: Venn by Two Sigma. For illustration purposes only.

We encourage those looking for a deep dive on factors to visit our Factor Investing & Analysis Guide.

To illustrate an example of total portfolio factor analysis, Exhibit 3 below presents a 60/40 portfolio as seen through the Two Sigma Factor Lens. Our goal is to identify the factors that drive this portfolio's exposure, risk, and return. Importantly, note how we are able to quantify each holding's contribution to the total portfolio, enabling actionable insights.

Exhibit 3: Two Sigma Factor Lens Exposure, Risk, and Return Analysis Exposure Decomposition

Exposure Decomposition

Risk Decomposition

Return Decomposition

Source: Venn by Two Sigma. The 60/40 Equities and Bonds model portfolio used for this analysis rebalances quarterly.

Key Portfolio-level takeaways include:

- The portfolio has a beta of 0.79 to the Equity factor, with 0.15, or 19% of that Equity exposure, actually driven by the high yield bond sleeve.

- Over 90% of the total portfolio risk is attributed to the Equity factor.

- The Foreign Currency factor caused an approximate 90 basis points drag on return per year, primarily due to the unhedged global equity position.

Part6

Challenges Associated with Implementing a Total Portfolio Approach

We believe there are three main challenges when implementing a TPA strategy:

- Building and maintaining a factor lens

- Preparing data for analysis

- Bringing together private and public assets

Building and Maintaining a Factor Lens: Crafting a factor lens is complex. With countless potential factors, each must be designed to be as independent as possible while providing substantial explanatory power. If factors are neither independent nor explanatory, risk analysis can become ineffective or misleading. Thus, equal emphasis should be placed on the philosophy of the collective factor lens as well as the selection and construction of individual factors.

The Two Sigma Factor Lens is constructed with four core pillars:

- Holistic: by capturing the large majority of cross-sectional and time-series risk for typical institutional portfolios.

- Parsimonious: by using as few factors as possible.

- Orthogonal: with each risk factor capturing a statistically uncorrelated risk across assets.

- Actionable: such that desired changes to factor exposure can be readily translated into asset allocation change

In addition, the process of ingesting, updating, and scrubbing data needed to maintain a factor lens can be expensive, time consuming, and prone to error. This makes maintaining a sophisticated factor lens difficult within limited resources or infrastructures such as excel.

Preparing Data for Analysis: To effectively analyze a total portfolio, it is crucial to ensure that the underlying data is consistent and comparable. This process may involve overcoming challenges such as holdings availability and other data-related issues.

For instance, when hedge funds are part of a portfolio, obtaining timely holdings data can be difficult or even impossible, rendering holdings-based factor analysis unfeasible. One solution is to adopt a returns-based approach to factor analysis, which relies on a regression-based method. By using the time series of returns from an asset, manager, or total portfolio as the only required input, this approach significantly simplifies data requirements. This makes total portfolio analysis much more accessible by reducing data barriers to valuable insights. Venn primarily employs a returns-based methodology, and also offers additional insights through holdings data.

Furthermore, the quality of analysis is only as strong as its weakest link. Various proxying techniques can address these challenges, facilitating a more robust and comprehensive analysis.

- Consider a scenario where a manager only has quarterly data, while the rest of the portfolio data is available daily. In such cases, using interpolation to convert the quarterly returns into a daily frequency can be beneficial, otherwise all of the information found in daily volatility is essentially lost. This adjustment allows for daily-level total portfolio analysis, providing more detailed insights into risk and attribution.

- In cases where an asset has a limited historical data set compared to the rest of the portfolio, backfilling with returns from a similar asset with a longer history can be advantageous. This approach enables total portfolio analysis over an extended timeframe, potentially enhancing the accuracy and depth of risk assessment.

Bringing Together Private and Public Assets: The growing popularity of private, or alternative assets, has highlighted the unique data challenges they present. These challenges are evident not only when considering private assets in isolation but also when integrating them into a comprehensive total portfolio that includes public assets.

- Private assets, not being exchange-traded, are marked to valuation, which can result in returns that lag behind public markets. This delay can cause private assets to experience drawdowns or rallies several quarters after public markets. Additionally, they may exhibit artificially low volatility, complicating risk analysis when combined with public assets. While this may suggest diversification on paper, the reality might differ.

- Private assets typically report performance on a quarterly basis, often with data that is several quarters outdated. These challenges force total portfolio analysis to operate with the same issues. Consequently, integrating private and public assets for comprehensive analysis can be impractical without effective data processing.

Technologies such as Venn’s Private Asset Lab can help address these issues to view private asset returns through a public lens. For example, desmoothing, interpolation, and extrapolation, can use a public proxy as a reference point to address different challenges of private asset returns. In the chart below, we summarize the role of each technique at a high level.

Exhibit 4: The Steps to View Private Asset Returns Through a Public Lens

Source: Venn by Two Sigma. For illustration purposes only.

Part 7

Looking Beyond Factor Analysis for a Total Portfolio Approach

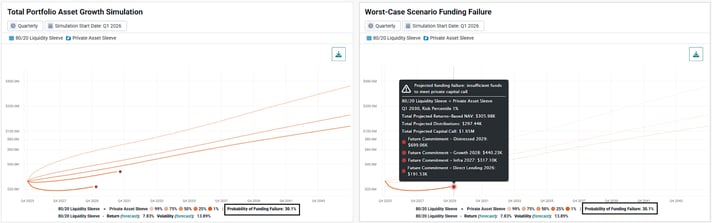

It is important to recognize that total portfolio analysis extends beyond returns-based factor analysis. For portfolios comprising both private and public assets, managing liquidity is crucial, particularly as private asset funds call committed capital. In such scenarios, technology can facilitate liquidity modeling of the total portfolio.

Venn by Two Sigma offers Total Portfolio Asset Growth Simulation within its Private Asset Lab. This tool integrates techniques like cash flow modeling, Monte Carlo simulations, and adjustable inputs such as cash flow parameters or CMA-based forecasts. These methods help investors to estimate the probability of funding failure up to 30 years into the future, providing insights into risks across various scenarios. In Exhibit 5, we show an example of this type of liquidity modeling at the total portfolio level.

Exhibit 5: Total Portfolio Asset Growth Simulation and Measuring the Probability of Funding Failure

For those interested in a deeper exploration of incorporating private assets into a total portfolio, we recommend reviewing our guide on Understanding Private Assets. You can also view our webinar on managing total portfolio liquidity.

Part 8

How Venn Enables a Total Portfolio Approach

A TPA challenges the traditional ACA, which can make its adoption intimidating. However, both approaches can be complementary. In fact, comparing their similarities and differences can yield valuable insights into portfolio risks, and many practitioners find merit in both perspectives. We believe a TPA is a sharper tool when it comes to understanding the independent and fundamental drivers of risk for a total portfolio, and how each underlying holding contributes to the total portfolio outcome.

For those exploring this approach, technology like Venn can be a powerful enabler. Venn offers a cloud-based platform tailored to facilitate a TPA, equipped with features to easily address its associated challenges. As has been discussed throughout this article, this includes providing users with the turn key Two Sigma Factor Lens for risk analysis, methods to overcome data challenges, as well as ways to analyze private and public assets, together. Get in touch with us to learn more or request a demo.

We also walk through the differences between a traditional asset class approach and factor approach in this webinar recording — access it now to see Venn in action.

References:

1Full history correlation measured from 3/27/2008–4/7/2025. The highest rolling 1-year correlation was over the period ending on 3/13/2020. Global equities represented by the iShares MSCI ACWI ETF (ACWI). USD-denominated high-yield bonds represented by SPDR Bloomberg High Yield Bond ETF (JNK).

Private asset portfolios are less liquid than public asset portfolios and have additional risks, including the risk of loss. Desmoothing, extrapolation, and interpolation use historical data and relationships among proxies to make estimates. These estimates will not always predict future results and have inherent limitations. Cash flow modeling is dependent on assumptions of uniform fund behaviors according to fund characteristics, and historical data availability. The future cash flow timing and needs of specific investments will differ from the model results, at times significantly.

Proxies are for estimation purposes only and have many inherent limitations. The methodology for calculating potential proxies was chosen in our professional judgement, and will not always yield the most accurate available proxy. Our potential proxy suggestions are not a recommendation as to any portfolio, allocation, strategy, or investment nor an offer to purchase or sell any security.