Returns-based factor analysis is a great way to uncover the fundamental drivers of investments or portfolios. This may mean getting to the bottom of an opaque alternative fund’s performance, or decomposing the risk of a complicated multi-asset portfolio.

Factor analysis can also serve as a reminder that even the simplest strategies are often exposed to more factors than they might seem to be. Speaking from the U.S perspective, a great example of this is investing in market-cap weighted global equity markets.

What’s Going On Under the Hood of Global Equities

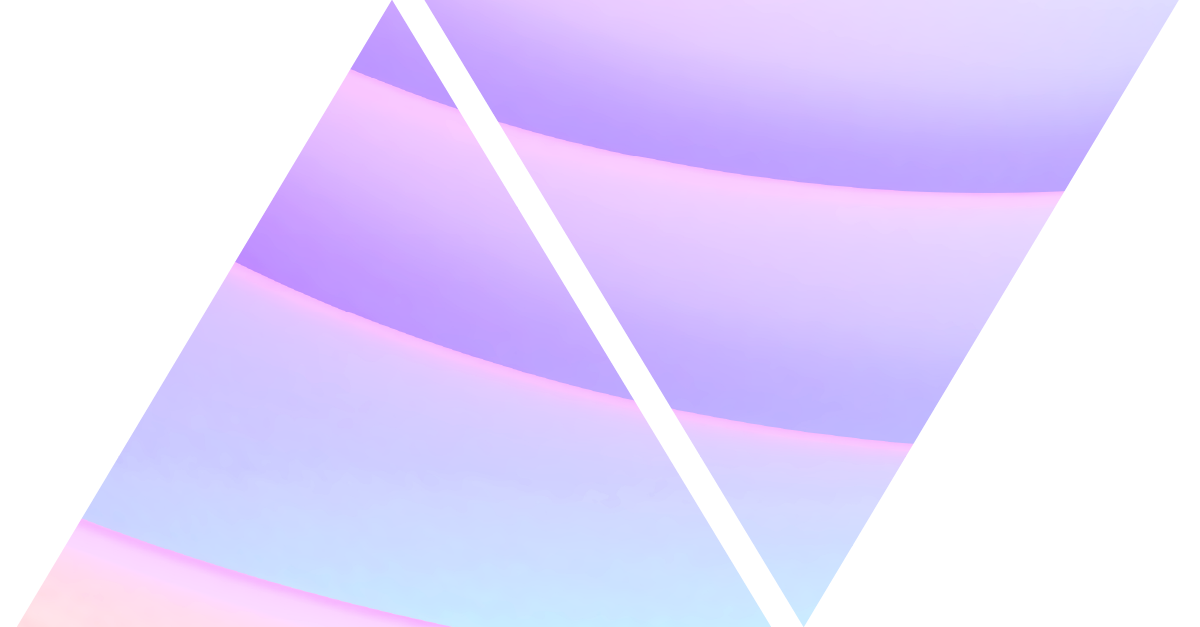

When evaluating unhedged global equities,1 one might expect Equity factor exposure along with Foreign Currency. However, using the Two Sigma Factor Lens, Venn revealed statistically significant exposure to Equity, Interest Rates, Commodities, Emerging Markets, and Foreign Currency factors. Put another way, this global equity position may benefit from rising equity markets, falling interest rates, higher commodity prices, outperformance of emerging markets (EM), or the appreciation of foreign currencies vs the USD.

For global investors, it may be the case that some of these exposures are unexpected.

Exhibit 1: Factor Exposures of Global Equities, Jan 2002–August 2023

Source: Venn by Two Sigma. Period from 1/2/2002–8/18/2023.

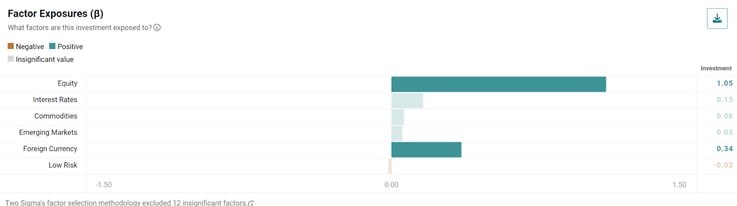

We can also break down how these factors have contributed to return over this more than two decade period. For example, it’s intuitive that Equity was the dominant contributor to return (and risk, as well), but Foreign Currency and Interest Rates also had a meaningful impact. More specifically, they contributed -0.72% and 0.39% to annualized returns, respectively.

Exhibit 2: Factor Contributions to Return of Global Equities, Jan 2002–August 2023

Source: Venn by Two Sigma. Period from 1/2/2002–8/18/2023.

A Deeper Understanding of Global Equity Factor Exposure

- Foreign Currency Factor: Venn’s Foreign Currency factor is constructed to be uncorrelated with Equity, Interest Rates, Credit, and Commodities factors via residualization. Practically speaking, this means that the exposure to foreign currencies associated with an unhedged investment manifests itself across multiple factors.

Referring back to Exhibit 1, the resulting betas to a factor such as Interest Rates likely represents the exposure that was “pulled out” of Foreign Currency via residualization.

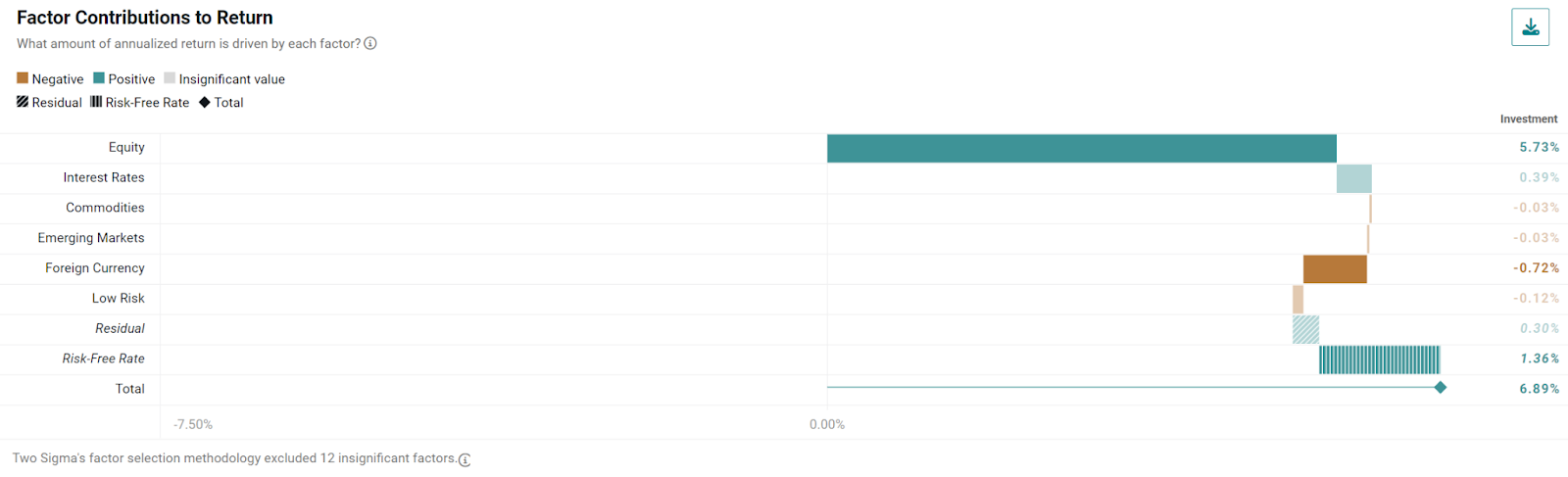

This same concept can be viewed in a different way by looking at relative exposure between global equity and its currency hedged equivalent in Exhibit 3. In this relative view, the magnitude of Equity exposure is greatly reduced as it now represents an active bet instead.

Reiterating our earlier findings, many might not realize that the choice to be unhedged rather than hedged has historically been a bet on factors beyond just Foreign Currency.

Exhibit 3: Active Factor Exposures of Global Equities vs Currency Hedged Global Equities, Jan 2002–August 2023

Source: Venn by Two Sigma. Period from 1/2/2002–8/18/2023.

- Emerging Markets Factor: We believe EM should represent its own independent factor from other correlated factors.2 Notably, as shown in Exhibit 3, comparing global equities vs a currency hedged equivalent yields relative Emerging Market factor exposure.

Important context is that our EM factor considers equity, fixed income, and a currency component. Theoretically, holdings for the chosen global equity index should be identical regardless of the hedging approach. This implies that any relative EM factor exposure for unhedged global equities is being driven by its EM currency component, an intuitive result.

Making More Informed Asset Allocation Decisions

It is somewhat common knowledge that an unhedged bet on global equities is a bet on foreign currency as well, but Venn’s factor analysis is a healthy reminder nonetheless. Using the Two Sigma Factor Lens, we isolated and quantified entangled exposures within Foreign Currency such as Equity, Commodities, and Interest Rates.

This analysis allows for a deeper understanding of the exposure and return contribution that has come with accessing unhedged global investments, but it can also be critical for workflows such as multi-asset portfolio analysis or manager due diligence. Ultimately, the decision to hedge or not hedge currencies is not inherently good or bad, but rather an asset allocation choice.

In an upcoming piece, we will apply this type of factor analysis to a global bond manager, using just returns to reveal how they approach managing currencies when investing abroad.

References

1 Global equities are represented by the MSCI ACWI Index

2 Venn’s Emerging Markets factor is orthogonalized with Interest Rates, Credit, and Commodities, and Equity

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Any statements regarding planned or future development efforts for our existing or new products or services are not intended to be a promise or guarantee of future availability of products, services, or features. Such statements merely reflect our current plans. They are not intended to indicate when or how particular features will be offered or at what price. These planned or future development efforts may change without notice. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

This article may include discussion of investing in virtual currencies. You should be aware that virtual currencies can have unique characteristics from other securities, securities transactions and financial transactions. Virtual currencies prices may be volatile, they may be difficult to price and their liquidity may be dispersed. Virtual currencies may be subject to certain cybersecurity and technology risks. Various intermediaries in the virtual currency markets may be unregulated, and the general regulatory landscape for virtual currencies is uncertain. The identity of virtual currency market participants may be opaque, which may increase the risk of market manipulation and fraud. Fees involved in trading virtual currencies may vary.