why venn?

Venn applies Two Sigma’s expertise in research, data science, and technology to modernize the analytics experience and help institutional investors embrace a quantitative approach to managing multi-asset portfolios.

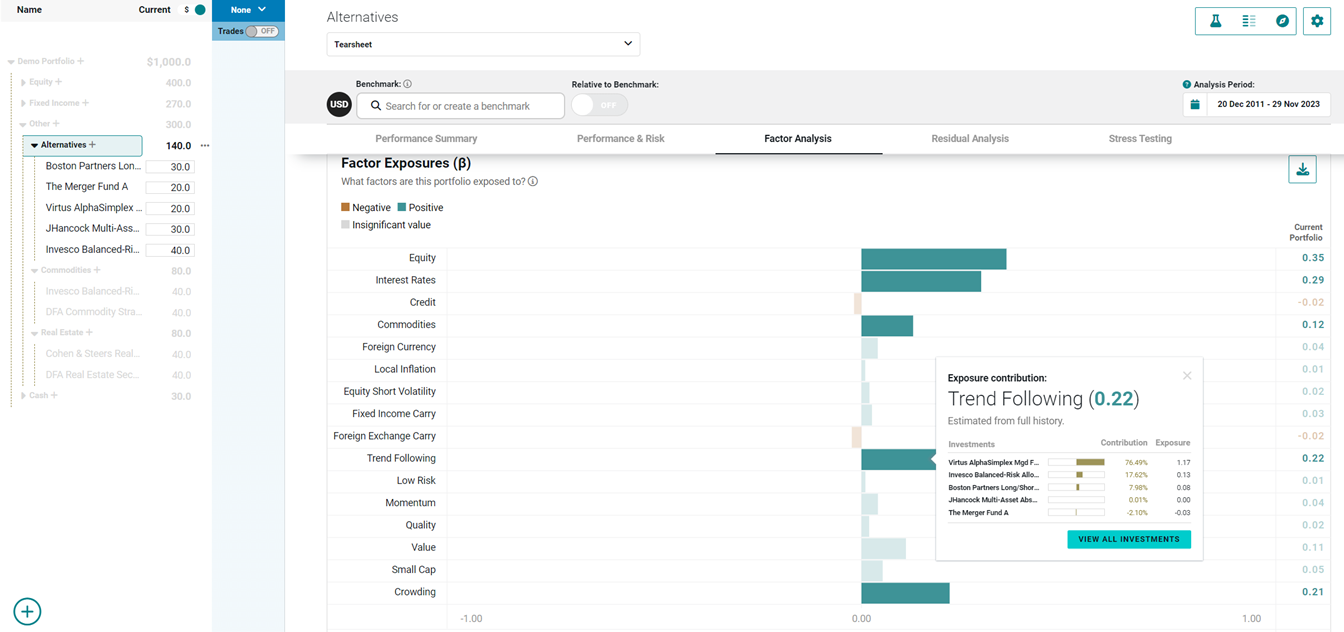

Get an x-ray view into potential

manager performance and risk.

Help find the managers best positioned to meet your objectives.

- Understand whether new managers could enhance the risk/return profile of your portfolio.

- Combine qualitative views with quantitative insights to help determine if managers are delivering.

- Find investments that may hedge unwanted risks or provide future growth.

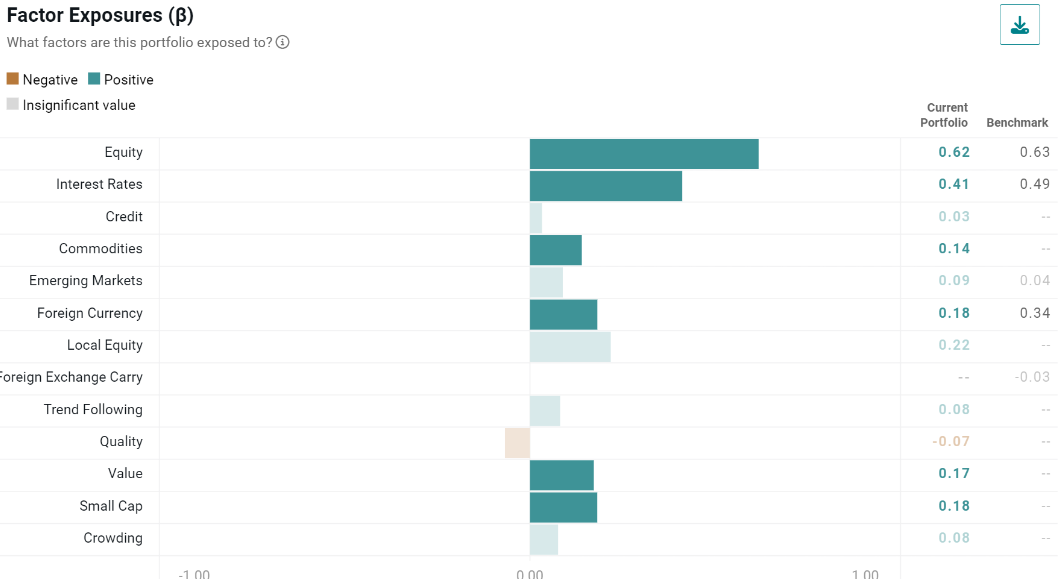

Take a factor-based approach to strategic

and tactical asset allocation.

Evaluate the risks in your portfolio.

- Move beyond asset-class specific approaches and take a more fundamental view.

- Understand the right mix of assets for your long-term portfolio objectives.

- Identify portfolio areas that do not align with your forecasts or need to be rebalanced.

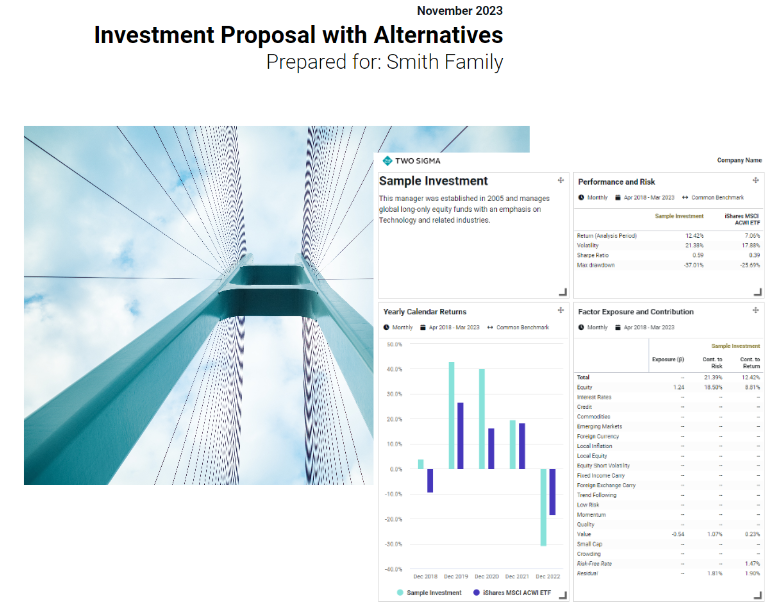

Streamline client and investment committee reporting.

Quickly create polished presentations and reports.

- Produce reports for ongoing monitoring and external presentations.

- Demonstrate how tactical asset allocation decisions could impact performance.

- Communicate your strategies for market volatility with scenario analysis and drawdown reports.

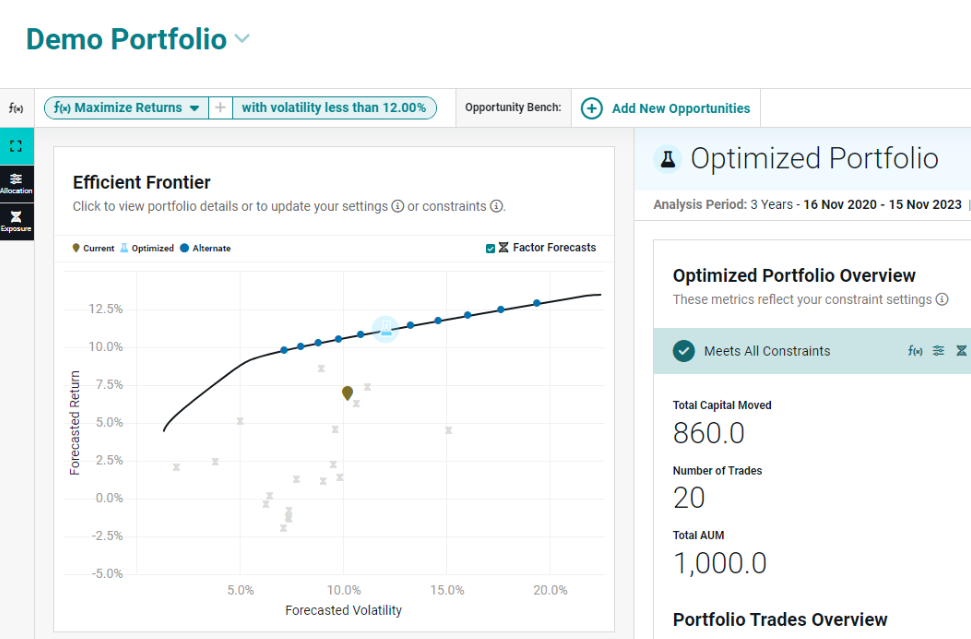

Work more efficiently with our modern interface.

Upload your data and let Venn do the work.

- Stop building your own models in Python or Excel. With Venn, data and analysis can be ready in seconds.

- Streamline your data management with our investment library.

- Standardize forecasts, benchmarks, and objectives across your organization.

Thought Leadership

Market, Industry, and Analytical Insights

Client Spotlight

Heartland Trust's largest challenge was finding a differentiated way to analyze risk in detail. They partnered with Venn to help with several key workflows.

Analyzing Private Assets

Private asset returns are typically smoothed and infrequent, reducing transparency. Venn tools can help private assets look and feel more like a public market proxy.

The Venn Pillar Series

At Venn, we believe that independent risk factors across asset classes are more precise tools for investment analysis and can help better understand portfolio diversification.