In recent blogs, we have discussed how private and public market investment returns can be driven by the same fundamental risk factors. This laid the foundation for using techniques such as desmoothing, interpolation, and extrapolation to view private assets through a familiar public lens.

Looking beyond time series returns, there are structural differences between private and public markets that require specialized tools for deep due diligence. In fact, in a recent wealth management survey report from CAIS and Mercer, 35% of investment advisors cited due diligence concerns as a barrier to investing in private assets.1

To support existing and potential private market investors, we are developing Venn’s Private Asset Lab (PAL), a new module that can increase risk management capabilities in private assets by improving transparency and data accessibility. Currently in beta, this package of data and tools has been developed with extensive client feedback, purpose-built analytics, and a plan to release deeper private asset capabilities over time.

PAL and Private Market Cash Flows

One example of private asset nuance where PAL can help is cash flow dynamics. In private markets, limited partners (LPs) must commit capital up front to general partners (GPs), who can then call on that capital over time for investment. Similarly, GPs will then distribute profits back to LPs over time. This dynamic, combined with the illiquid and legally binding nature of private asset investing, creates a strong need for cash flow modeling.

Currently in Venn’s PAL, you can find Preqin-sourced cash flow data for close to 7,000 private asset funds, Preqin performance data2 for roughly 18,000 funds, and characteristics for close to 80,000 funds. Using this data, or user-provided data, Venn has the ability to model cash flows, helping investors navigate the flow of transactions between themselves and GPs. Given that cash flow management is a primary consideration for LPs, let’s dive further into associated challenges and Venn’s ability to model cash flows.

Cash Flow Management Challenges in Private Markets

When investing in private markets, the liquidity that LPs need for their committed capital may be unclear. This can lead to suboptimal decision making while waiting for capital to be called, ultimately affecting returns. Similarly, LPs need to make sure they have enough capital on hand to meet commitments, otherwise they risk defaulting on payments.

Switching to the portfolio level, cash flow dynamics come with unique benefits but also more complexity. Assuming vintage diversity,3 a portfolio of private assets allows investors to meet capital calls with distributions from more mature funds. This can lead to a potentially self-sustaining allocation. However, one must manage contributions and distributions simultaneously, maintaining the desired asset allocation in the face of closing and opening funds.

You’ve got a PAL in Me

To help investors better manage their private capital cash flows and asset allocation, Venn’s PAL uses the Takahashi-Alexander Forecast Model (TA Model).4 More specifically, the TA Model projects cash flows and net asset values (NAV) utilizing fund specific inputs alongside model parameters that are calibrated on historical data.5

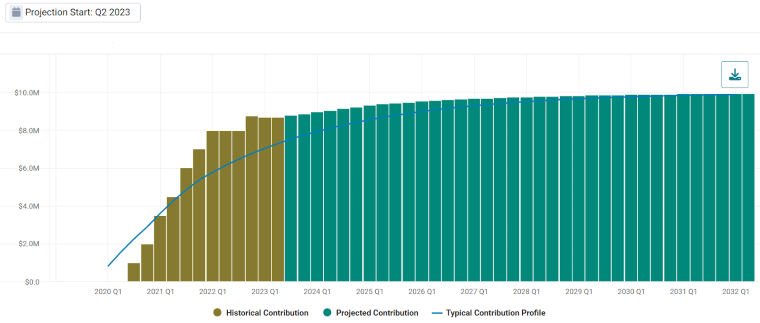

For example, in Exhibit 1 we show cumulative contributions to an anonymous balanced private equity fund with $10m capital committed and a vintage of 2019. The chart shows historical (olive), projected (teal), and a typical fund’s (blue)6 cumulative capital called over time. In Venn, we also provide flexibility to view this and other data in non cumulative or table format.

Exhibit 1: Cumulative Contributions of a Private Equity Fund

Source: Venn by Two Sigma

For a hypothetical LP who committed to this strategy, historically we can see they invested roughly $9m of their committed capital through Q1 2023 (looking at the olive bars). In teal, we project how remaining committed capital might be called in the future. Projected contributions, in conjunction with knowledge that this fund has historically called capital faster than a typical private equity fund, may provide important context as to how much capital an LP might want to keep on hand for Q3 2023 versus Q1 2026, for example.

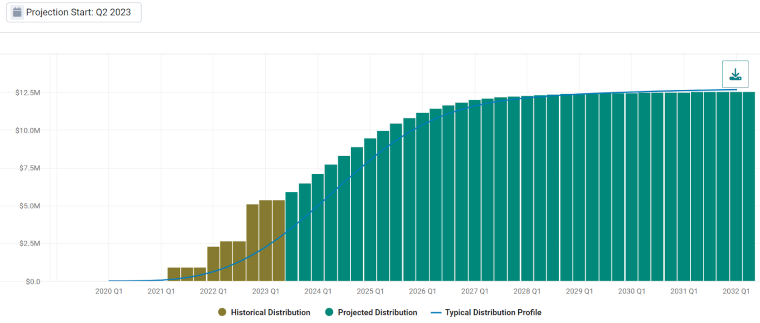

In Exhibit 2, we show the same chart but for the GP’s distributions back to the LP.

Exhibit 2: Cumulative Distributions of a Private Equity Fund

Source: Venn by Two Sigma

In this example, we see that this fund also distributed back more capital than is typical to the hypothetical LP early in its life cycle. If we assume typical NAV growth, this suggests lower quarterly distributions in the future, but providing the LP with more returned capital than typical through 2028. This may provide confidence that there is flexibility to commit capital to other funds earlier than expected.

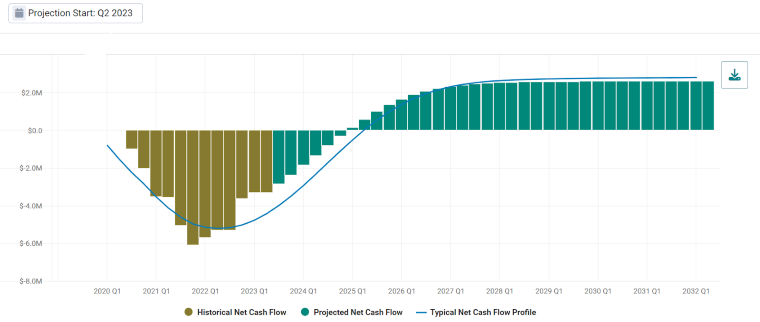

In Exhibit 3 we show net cash flow for this strategy, revealing the well known “J-curve” in private assets. This is the idea that cumulative net cash flows begin as negative when capital is being called, but transition to positive as distributions become more prominent.

Exhibit 3: Cumulative Net Cash Flow of a Private Equity Fund

Source: Venn by Two Sigma

Applying Cash Flow Modeling to a Diversified Private Asset Portfolio

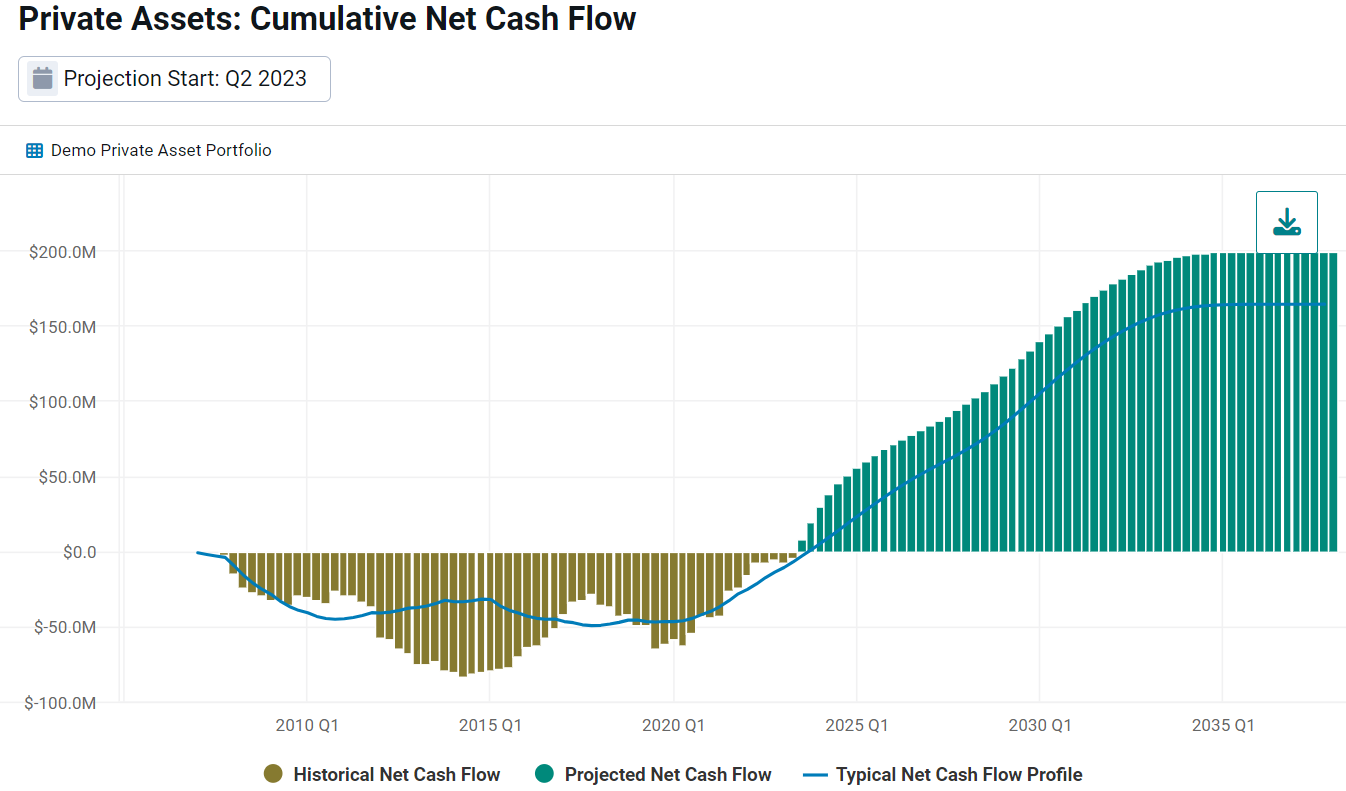

As we discussed earlier, pacing cash flows for portfolios can address critical challenges such as funding risks and how to maintain a consistent private asset allocation. For example, we can run PAL analysis on Venn’s demo private asset portfolio. This represents a commitment of $20m in capital to each of its 17 holdings across different asset classes and geographies, each with a different vintage year from 2006–2022.

In Exhibit 4, we show net cash flows across all funds in our demo portfolio, providing a holistic view of both historical and projected data. For example, after Q4 2021, we see positive cumulative net cash flow exceeding that of a typical version of the portfolio, suggesting strong distributions back to investors. This may be due to high growth of the underlying assets, which we will evaluate in the next section.

Exhibit 4: Cumulative Net Cash Flow of a Private Asset Portfolio

Source: Venn by Two Sigma

Using Venn’s PAL for Asset Allocation

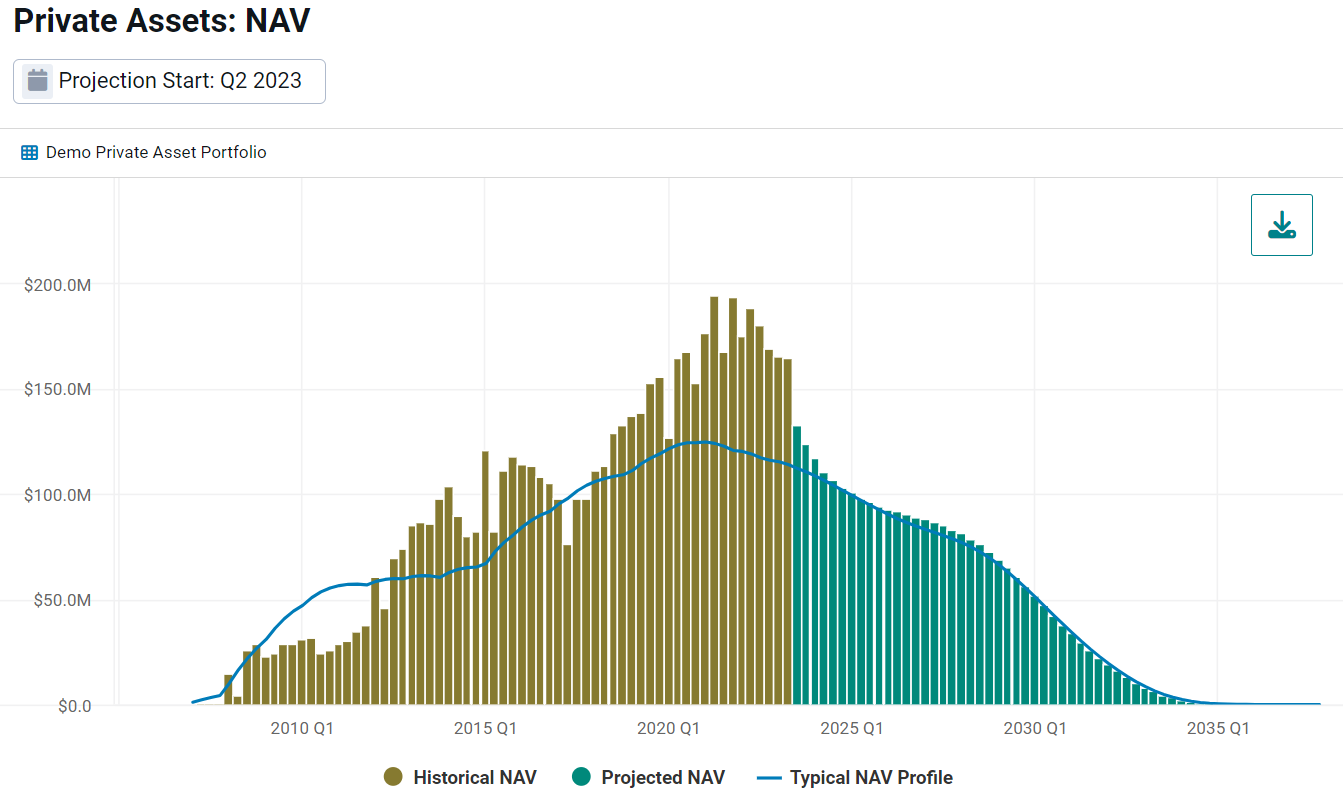

NAV represents the value of an individual fund or portfolio at any given time, based on net cash flows but also on realized or assumed growth rates of the underlying investments. If we think about contributions, distributions, and net cash flows as tools for cash flow management, one might consider NAV as a tool for asset allocation.

For example, if we assume we want to maintain a 10% allocation to private assets across a $1b portfolio, when the NAV of our portfolio is above or below $100m we would know we are deviating from our asset allocation target. This can be critical information when anticipating transactions that may be needed to maintain a certain portfolio weight to private markets.

In Exhibit 5, this may mean selling existing interests around 2018–2023 in secondary markets, or committing new capital such that capital calls might begin around 2025, when NAV falls below $100m. As we can see, our demo portfolio had strong growth in its underlying assets compared to a typical version of the portfolio, which may have contributed to it ending up with higher than typical cumulative net cash flow in Exhibit 4.

Exhibit 5: Net Asset Value of a Private Asset Portfolio

Source: Venn by Two Sigma

Keeping Up With the Pace of Private Asset Growth

Especially in wealth management, the interest in allocating to private capital is on the rise. For example, using the same report cited in our introduction, 85% of investment advisors intend to increase allocations to alternative asset classes in the next couple of years, inclusive of private assets.

As private assets continue to grow, so too will the need for tools designed to reduce their complexity while increasing transparency and accessibility. Venn aims to be a premiere platform for intuitive and purpose-built private asset analytics, beginning with the first iterations of Venn’s PAL. We look forward to continuing to develop our Private Asset Lab, releasing deeper private asset capabilities over time.

Private asset portfolios are less liquid than public asset portfolios and have additional risks, including the risk of loss. Cash flow modeling is dependent on assumptions of uniform fund behaviors according to fund characteristics, and historical data availability. The future cash flow timing and needs of specific investments will differ from the model results, at times significantly. Certain data provided by Preqin Ltd. Copyright 2024 Preqin Ltd. All rights reserved.

References

1 The State of Alternative Investments in Wealth Management

2 In addition to performance data such as Net IRR, Net Multiple, RVPI, and DPI, and % of capital called, Venn’s private asset lab offers Preqin-sourced data such as vintage, status, asset class, strategy, fund manager, fund size, and industry.

3 Vintage: a fund’s first year of investment or capital calls

4 Takahashi, D., and S. Alexander. 2002. “Illiquid Alternative Asset Fund Modeling.” The Journal of Portfolio Management 28 (2): 90.

5 Inputs can include fund start time stamp, as of date time stamp, capital committed, net asset value as of when projections start, and paid-in capital as of when projections start. Applied parameters to this data include rate of contribution, fund life expectancy, a factor describing changes in the rate of distribution over time, quarterly yield (%) and quarterly growth rate (%).

6 “Typical” outputs are model generated cash flows with hyperparameters best reflecting the fund’s universe. For a portfolio, typical represents a bottoms-up typical profile of each individual fund, aggregated into the portfolio level.

References to the Two Sigma Factor Lens and other Venn methodologies are qualified in their entirety by the applicable documentation on Venn.

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.