Investment Consultants

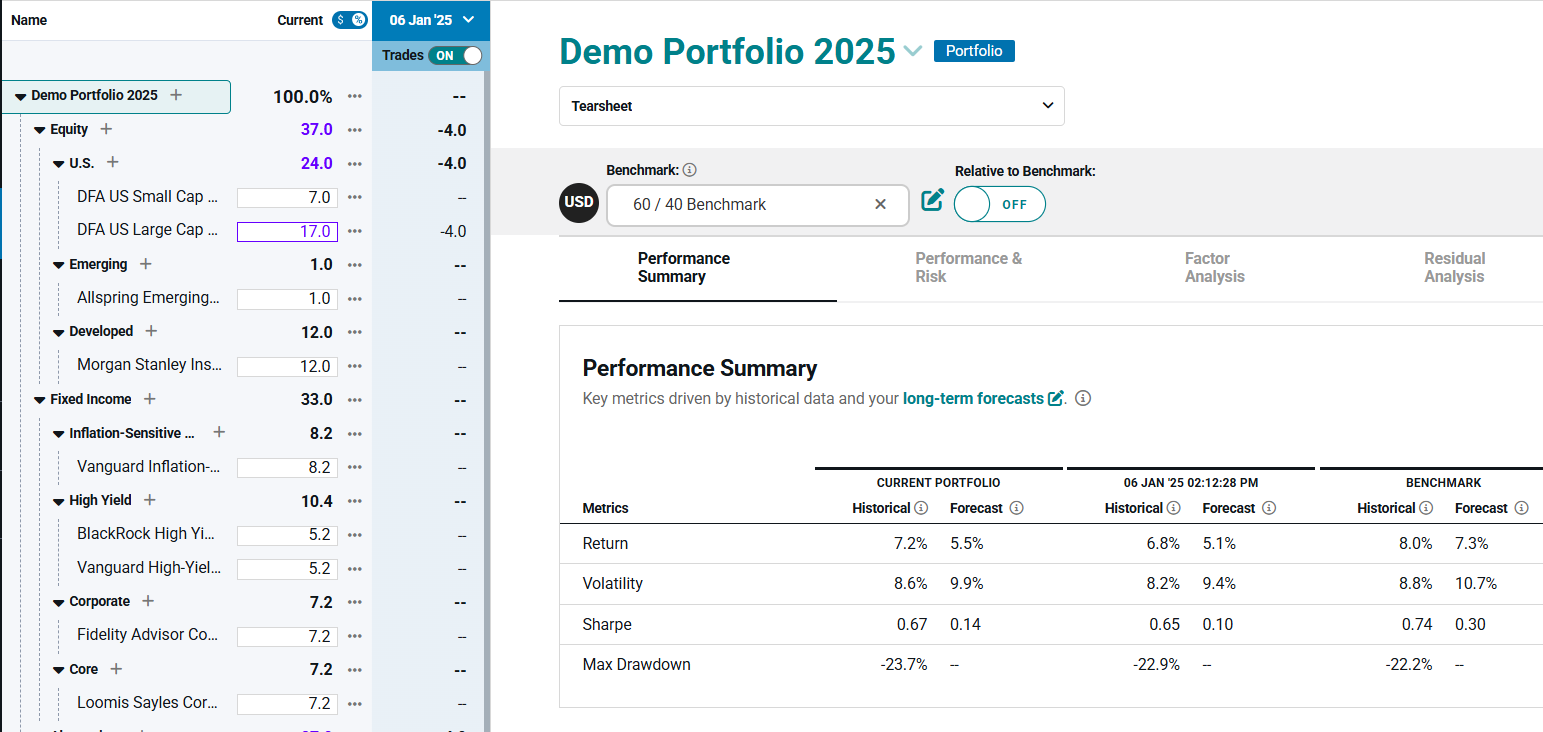

Consultants and OCIOs use Venn to help with quantitative manager evaluation, portfolio construction, total portfolio risk and return attribution, and stress testing.

Venn Use Cases

Venn helps investment consultants and OCIOs speed up calculations and quickly analyze multi-asset portfolios using traditional risk and return metrics, as well as risk factors. Our portfolio analytics solution can enhance analytical rigor and enable more robust peer group analysis.

Manager Due Diligence

Portfolio Construction

Risk and Return Attribution

Scenario Analysis

Custom Dashboards & Reporting

How Investment Consultants Use Venn

Manager Evaluation

Decompose manager risk and return and analyze the impacts of investments within portfolios

Portfolio Construction

Construct portfolios and run what-if asset allocation analysis using our intuitive and flexible UI.

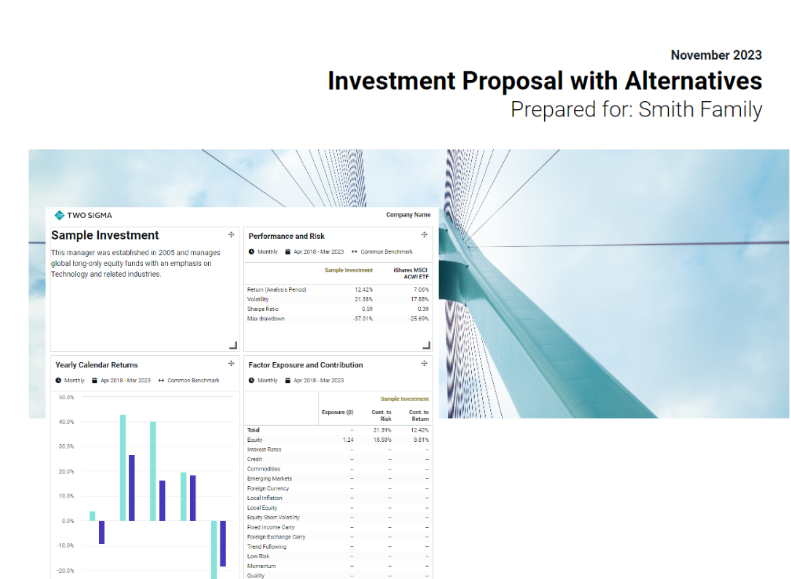

Stakeholder Reporting

Integrate our Report Lab module for polished and customizable reports and presentations.

Venn by the Numbers

250+

Clients

300,000+

Investments in Data Library

$25+ trillion

Client AUM

18

Factor Model

Venn allows us to do several things that create efficiency in our process. On the front end, we can quickly assess a manager’s return stream and perform an easy ‘sanity check’ early on in our research process. *

* The Venn subscriber featured here was not compensated for their statements. As a Venn subscriber, their use of portfolio analytics or other Venn features and their experience could differ from your organization’s due to their particular use of Venn, the version of Venn used, or other factors. Not all subscribers will be equally satisfied. The person providing this testimonial was selected based on a variety of factors, some of which are subjective. This document is for informational purposes only. Not an offer to buy or sell securities. Click here for Important Disclosure and Disclaimer Information.

Venn Case Study: Fiducient Advisors

As Fiducient has grown, relying on Excel increasingly slowed down output and created burdensome manual processes for completing manager due diligence and portfolio construction.

Common Questions

What goes into our Factor Model?

What is Private Asset Lab?

What is Report Lab?

Thought Leadership

Market, Industry, and Analytical Insights

Analyzing Private Assets

Private asset returns are typically smoothed and infrequent, reducing transparency. Venn tools can help private assets look and feel more like a public market proxy.

Client Spotlight

Fiducient Advisors needed to streamline portfolio construction, quantitative due diligence, and portfolio monitoring.

The Venn Pillar Series

At Venn, we believe that independent risk factors across asset classes are more precise tools for investment analysis and can help better understand portfolio diversification.