Exhibit 1: February 2023 Risk Factor Performance

Source: Venn by Two Sigma. The median and percentile columns measure the performance of each factor in the Two Sigma Factor Lens relative to the entire history of the factor in USD, using monthly data for the period March 1995 - February 2023

Cash is King

Our Two Sigma Factor Lens keeps track of cash considerations. For example, both our Equity and Interest Rates factors subtract out the local risk free rate from their returns, helping to isolate the true premium being captured.

For Factors like Equity, this cash consideration is very straightforward. For others, cash requires an additional layer of examination. Take, for example, our Fixed Income Carry factor, which goes long relatively high yielding 10-year sovereign bonds and short those that are lower yielding.2

Looking at 10-year yields as of 2/28/2023, you might think certain long and short positions are obvious, such as long U.S.10-year bonds and short Japanese government bonds (JGB). After all, the U.S.10-year is yielding 3.42% more than the Japanese 10-year.

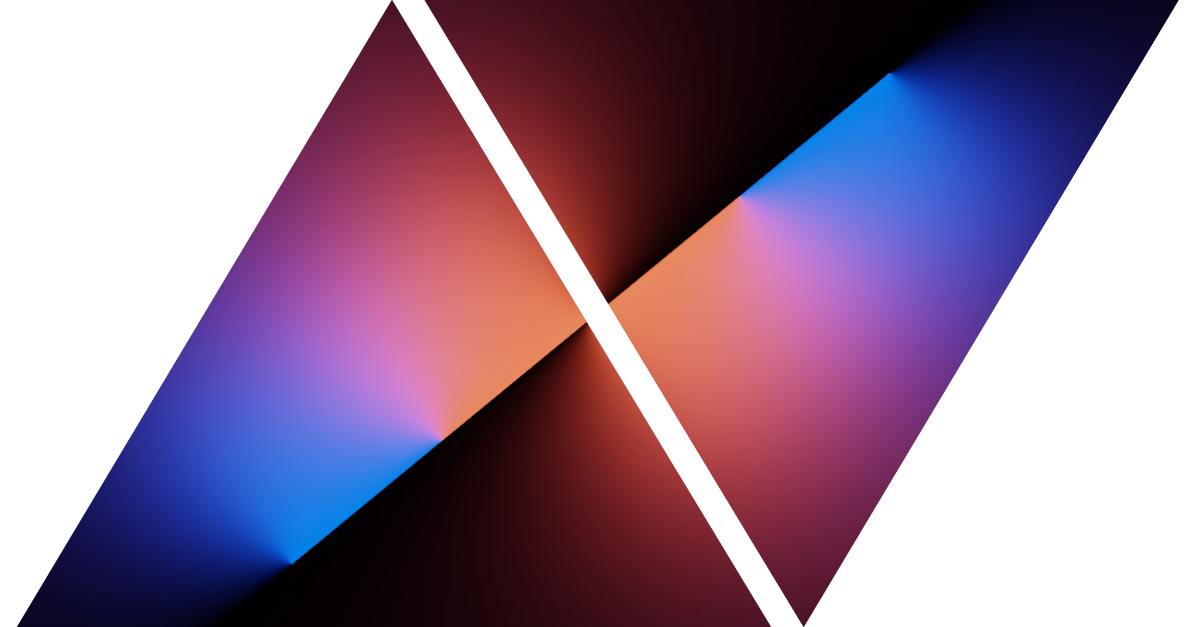

Exhibit 2: Yields on 10-Year Government Bonds

Source: Bloomberg as of 2/28/2023

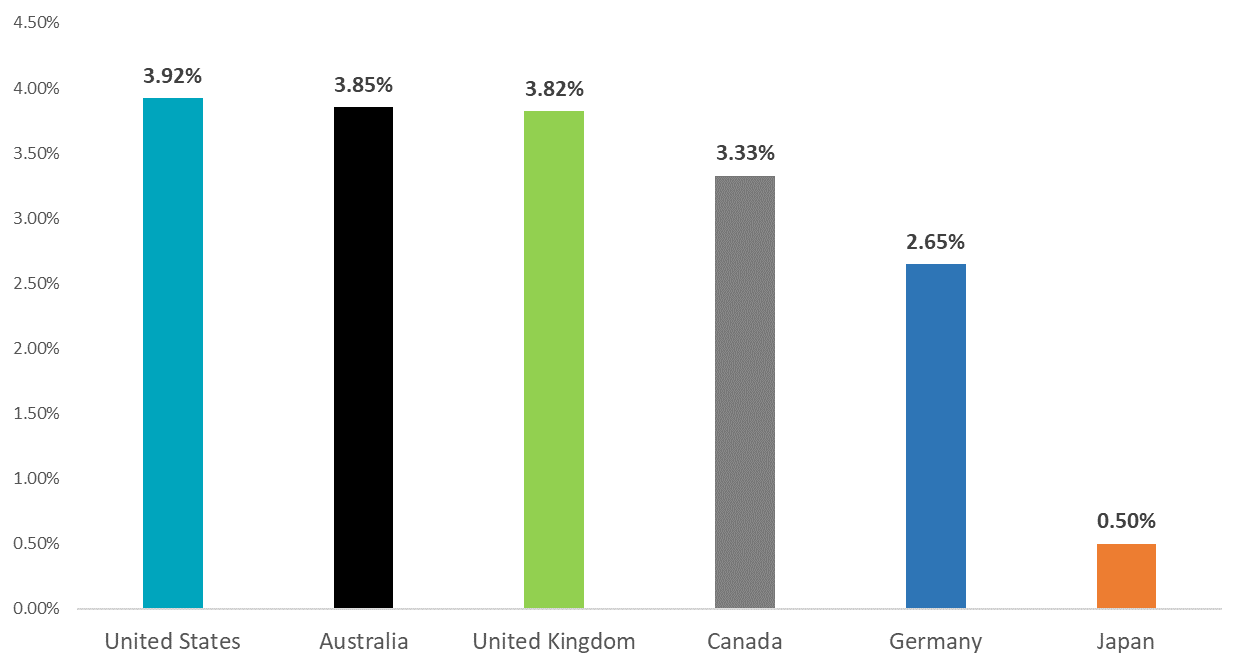

However, once we account for local cash rates via the local 3-month T-bill, we see that the term spread of Japan has become more attractive.3 In fact, among the countries considered in our Fixed Income Carry Factor, the U.S. currently has the second least attractive term spread, while Japan has the most attractive.

Exhibit 3: Term Spreads by Country

Source: Bloomberg as of 2/28/2023. Term spread measured by respective countries 10-year yield minus the 3-month yield

Yield Curves and Central Bank Policy

When it comes to evaluating how to implement carry strategies, yield curves are key. While not all government yield curves are inverted, most have significantly flattened amid rising rates and market uncertainty, leading to falling term spreads. The carry attractiveness of an asset is ultimately determined by this term spread. But what about Japan has kept its term spread so favorable?

The BOJ currently implements a Yield Curve Control Policy that targets short-term rates at -0.1% and a cap on long-term rates of 0.50%.4 This unique policy has caused Japan to maintain an attractive term spread relative to the rest of the world as shown in Exhibit 3. This affects positioning for our Fixed Income Carry factor, which compares term spreads on a cross-sectional basis. In fact, our factor went from a short to long position in the JGB around November 2022 and has been long ever since.

Notable Fixed Income Carry Positioning in February

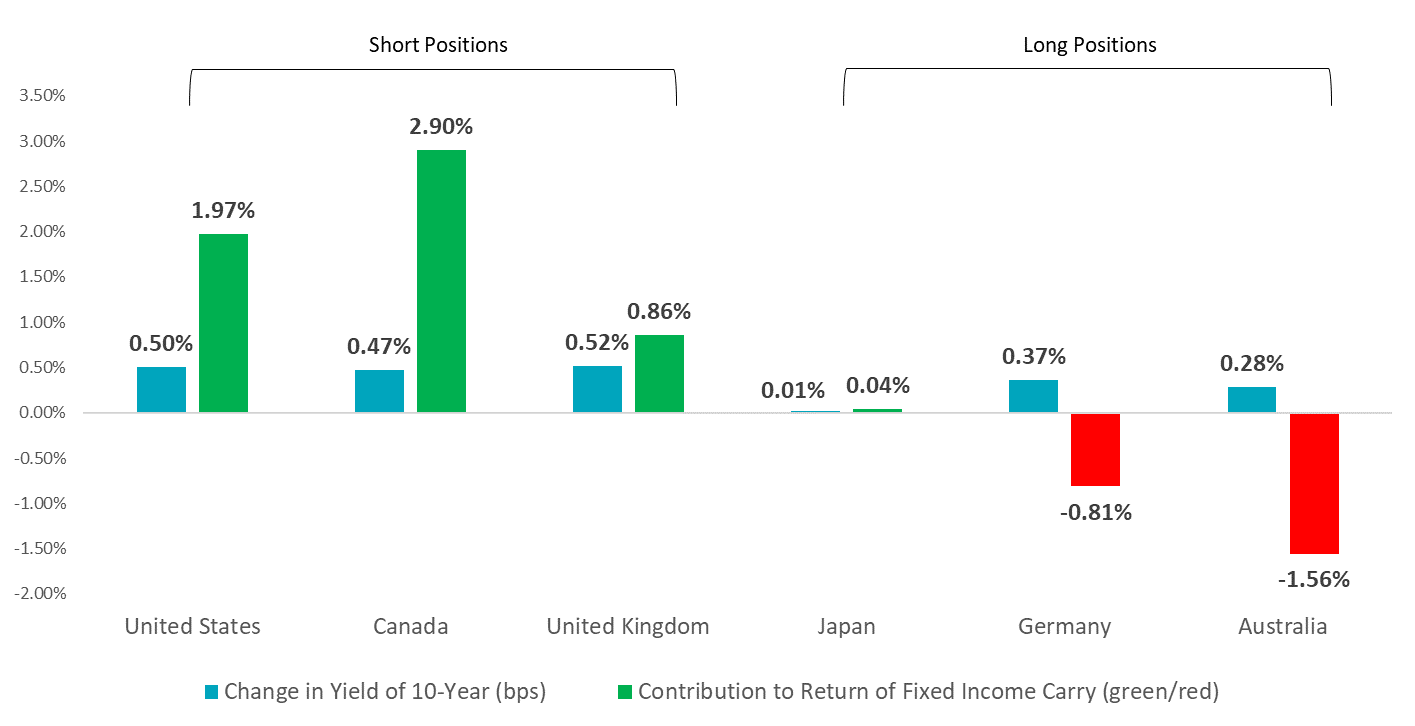

Getting more specific, in February our Fixed Income Carry factor (before residualization against Interest Rates) benefited from short positions in 10-year bond futures for the U.S., Canada, and the U.K., which together contributed close to 6% in positive return.

A long position in the JGB neither helped nor hurt the Fixed Income Carry factor in February, despite global bonds struggling for the month. It is reasonable to expect negative contributions to return from the long book amid rising rates, but given the central bank policy in Japan, JGB positioning was resilient for the long book in February.

Exhibit 4: Change in Yield for 10-Year Bonds and Contribution to Return for Fixed Income Carry in February

Source: Venn by Two Sigma as of 2/28/2023

References

2 Our Fixed Income Carry Factor is duration neutral and considers both term spread as well as a roll down component from 10 to 7 year maturities. It is residualized against our Interest Rates Factor.

3 Term spread= respective countries’ 10-year yield minus the 3-month yield

References to the Two Sigma Factor Lens and other Venn methodologies are qualified in their entirety by the applicable documentation on Venn.

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Any statements regarding planned or future development efforts for our existing or new products or services are not intended to be a promise or guarantee of future availability of products, services, or features. Such statements merely reflect our current plans. They are not intended to indicate when or how particular features will be offered or at what price. These planned or future development efforts may change without notice. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

This article may include discussion of investing in virtual currencies. You should be aware that virtual currencies can have unique characteristics from other securities, securities transactions and financial transactions. Virtual currencies prices may be volatile, they may be difficult to price and their liquidity may be dispersed. Virtual currencies may be subject to certain cybersecurity and technology risks. Various intermediaries in the virtual currency markets may be unregulated, and the general regulatory landscape for virtual currencies is uncertain. The identity of virtual currency market participants may be opaque, which may increase the risk of market manipulation and fraud. Fees involved in trading virtual currencies may vary.

.png)