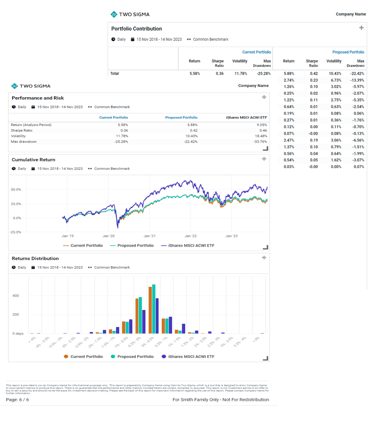

1. Compare current and proposed portfolios

Are you currently building and analyzing portfolios in a spreadsheet to calculate summary-level statistics and investment-level contributions? Venn can help replicate that process quickly and efficiently, and allow you to iterate on the fly to see how investment changes can impact the portfolio. Use Venn to highlight analytics relevant to current and proposed portfolios to help support your recommended allocation changes to persuade your audience. For example, you can examine the returns distribution and historical risk statistics of both versions of a portfolio to see which looks more attractive.

Are you currently building and analyzing portfolios in a spreadsheet to calculate summary-level statistics and investment-level contributions? Venn can help replicate that process quickly and efficiently, and allow you to iterate on the fly to see how investment changes can impact the portfolio. Use Venn to highlight analytics relevant to current and proposed portfolios to help support your recommended allocation changes to persuade your audience. For example, you can examine the returns distribution and historical risk statistics of both versions of a portfolio to see which looks more attractive.

2. Customize your reporting for multi-manager portfolios

Are you currently using slides, powered by data in spreadsheets, to build a portfolio proposal for your investment committee or end client? You can use Venn to easily create a report highlighting portfolio-level metrics, as well as analytics relevant to each line item in your portfolio, all in one report, without needing a spreadsheet. For example, the first few pages of your report can show portfolio-level summary metrics. Then, each subsequent page can show analytics specific to each of the line items, allowing you to zoom in and better understand how each investment impacts the full portfolio. Changes can be made on the fly - for example if you want to change the time period for the “Rolling Volatility” chart, simply adjust it in Venn directly, instead of having to update the formula in the spreadsheet.

3. Create personalized proposals for your audience

Are you spending your time on customizing and personalizing proposals? In addition to showing the proper amount of quantitative detail in your proposals, customizing the look and feel of any presentation can help captivate your audience. When building a report on Venn, you can add in your company’s logo, your client’s name, adjust the height and width of each chart or table and add other bespoke notes or disclosures. Similar to a slide deck, you can also create title pages and section header pages to better organize your presentation. Venn will maintain a log of these finished reports to maintain a history for recordkeeping purposes, should you ever need them.

View a full Report Lab demo here.

The information contained in this article is provided for general informational and educational purposes only, and should not be construed as investment advice. The contributor to this material is associated with a client of Two Sigma Investor Solutions, LP (“TSIS”). Neither TSIS nor its affiliates have compensated the contributor for his statements. The statements from the interview have been edited and reformatted by TSIS with the contributor’s approval. Unless otherwise noted, the contributor’s statements do not represent the actual views or opinions of TSIS or its affiliates, or any officers, directors, or employees thereof.

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Any statements regarding planned or future development efforts for our existing or new products or services are not intended to be a promise or guarantee of future availability of products, services, or features. Such statements merely reflect our current plans. They are not intended to indicate when or how particular features will be offered or at what price. These planned or future development efforts may change without notice. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

This article may include discussion of investing in virtual currencies. You should be aware that virtual currencies can have unique characteristics from other securities, securities transactions and financial transactions. Virtual currencies prices may be volatile, they may be difficult to price and their liquidity may be dispersed. Virtual currencies may be subject to certain cybersecurity and technology risks. Various intermediaries in the virtual currency markets may be unregulated, and the general regulatory landscape for virtual currencies is uncertain. The identity of virtual currency market participants may be opaque, which may increase the risk of market manipulation and fraud. Fees involved in trading virtual currencies may vary.