The Science of Finance

Venn is a sophisticated investment analytics solution powered by the quantitative expertise of Two Sigma.

Find out why clients of all sizes rely on us for our global multi-asset analytics, intuitive interface, and premium client service.

Recent Insights from Our Team

Enhancing Hedge Fund Due Diligence

Anthony Novara of Fiducient Advisors shows how he leverages Venn to help enhance hedge fund due diligence, especially in times of market volatility.

Breaking Down Barriers to a Total Portfolio Approach

The total portfolio approach (TPA) offers improved risk management and portfolio outcomes, yet most investors struggle to put it into practice.

April 2025 Factor Performance Report

April's market rollercoaster was primarily driven by tariff and trade war headlines, creating significant volatility across asset classes.

Venn by the Numbers

200+

CLIENTS

20+

Countries

$20+ Trillion

Client AUM

18

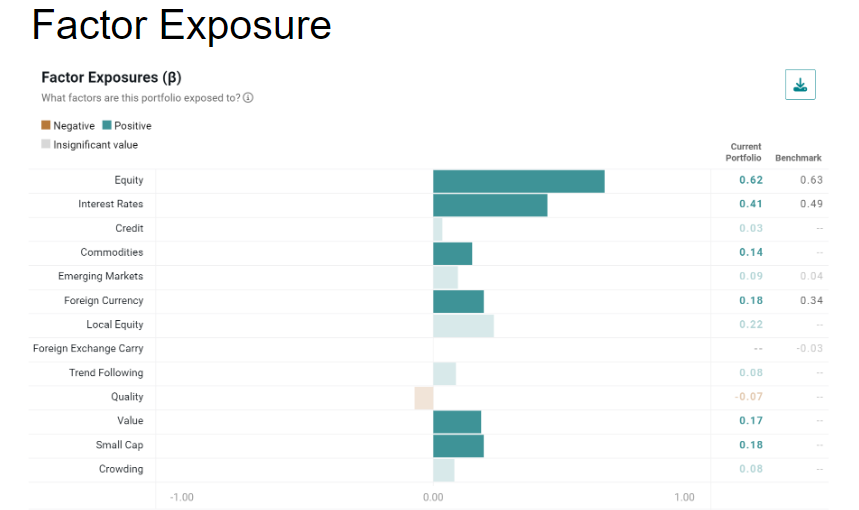

Factor Model

What is Venn?

Who We Serve

Our clients include asset owners, asset and wealth managers, advisors, and consultants who embrace a quantitative approach to multi-asset investment decision-making.

Institutional Asset Owners

Helping endowments, foundations, public plans, and pensions manage multi-asset portfolios, reduce risk, and build for the long term.

Wealth Managers and Advisors

Helping single and multi-family offices, wealth managers, private banks, and RIAs strengthen their processes and enhance decision-making.

Asset Managers

Helping managers efficiently analyze investments, conduct diligence, and manage risk.

OCIOs and Investment Consultants

Helping consultants streamline workflows, manage client strategy, and build their business.

Select Clients*

The Power of Venn

Our SOC 2 certified platform offers a modern and intuitive approach to solving problems. Use Venn to:

- Analyze Public and Private Investment Options

- Conduct Manager Due Diligence

- Optimize Portfolio Construction

- Design Compelling Reports and Presentations

Thought Leadership

Market, Industry, and Analytical Insights

Client Spotlight

Heartland Trust’s largest challenge was finding a differentiated and detailed way to analyze risk.

Analyzing Private Assets

Private asset returns are typically smoothed and infrequent, reducing transparency. Venn tools can help private assets look and feel more like a public market proxy.

The Venn Pillar Series

At Venn, we believe that independent risk factors common across asset classes are more precise tools for investment analysis and can help better understand portfolio diversification.