If an investment returned that same exact amount every month, the only relevant question is likely: “What’s the return?” In reality, investment returns go up and down which invites the opportunity for deeper analysis.

One’s first instinct may be to understand what is driving portfolio variation. While this is a great place to start, equally important is what percent of total portfolio variation one can explain.1

This is why one of Venn’s four core pillars is to be holistic, meaning that our approach to portfolio analytics attempts to explain the large majority of return variation. To achieve this goal, Venn’s Two Sigma Factor Lens uses a “less-is-more” approach, using 18 or fewer statistically independent risk factors that span across asset classes.

Measuring the Holisticness of a Less-Is-More Approach in Portfolio Analytics

To test how holistic our Factor Lens has been, we constructed five representative institutional portfolios for five different investor types.2 In Venn, we decomposed these portfolios into common risk factors, but also separated risk into what our Factor Lens can and cannot explain. The risk unexplainable by our Factor Lens is called residual.

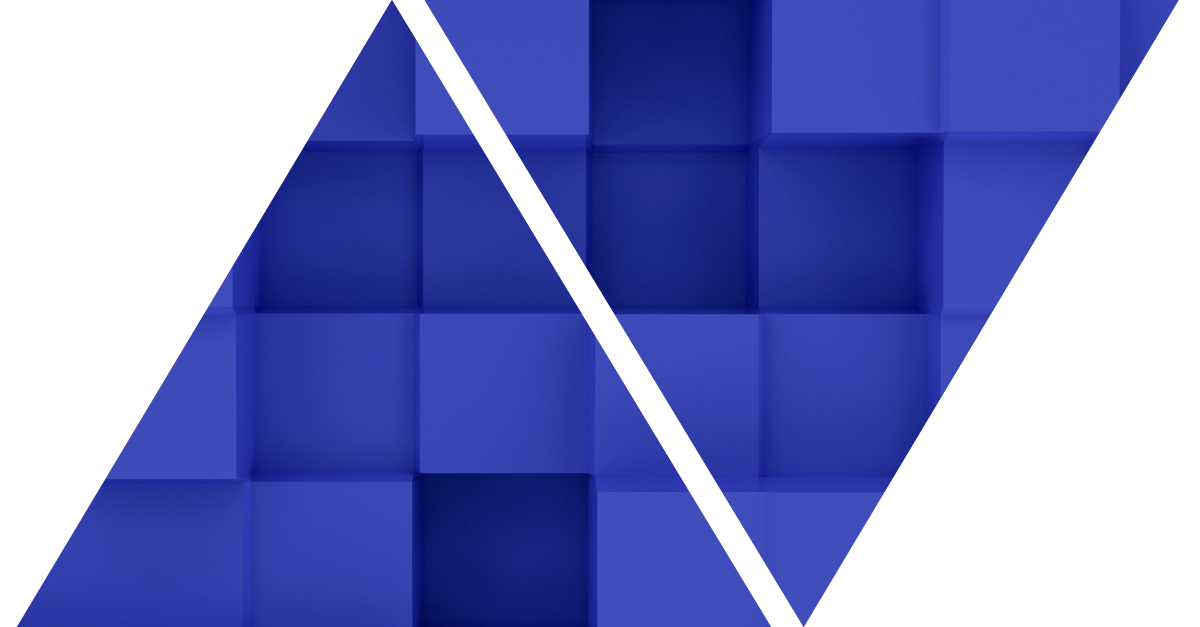

As a result, we are able to paint a clear picture as to what percent of portfolio variation our common risk factors are capturing among some of the largest investors in the world. Shown below, we believe that Venn’s Two Sigma Factor Lens not only explained the majority of risk, but in all cases it explained more than 90% of total variation in these representative institutional portfolios.

Spoiler: Equity, Interest Rates and Foreign Currency Factors explained a large majority of risk in these portfolios over the 5-year period ending Dec 31, 2021.

Percent of Risk Explained by Venn’s Two Sigma Factor Lens for Institutional Investor Types

Source: Venn by Two Sigma. See appendix for more information on the construction of representative institutional portfolios. Period analyzed was the trailing 5-year period ending June 30, 2023. Portfolios were rebalanced quarterly.

Are There Other Ways to Explain This Much Risk?

The short answer as to whether other approaches can explain this much risk is: yes. In fact, in 2018 we found an asset class framework to have similar explanatory power. However, as we mentioned earlier, there is more to Venn than just being holistic.

More specifically, Venn uses 18 or fewer factors to reduce confusion from overlapping risks among highly correlated asset classes. In addition, the independent nature of our factors may lead to better and more precise decision making. As we’ve shown, these characteristics can be achieved while still explaining over 90% of risk in institutional portfolios.

Put another way, when we think about Venn’s four fundamental pillars (see below), holistic is unique. It is not so much that Venn is holistic, but rather, that Venn is holistic while also providing a parsimonious, orthogonal, and actionable way to conduct portfolio analytics.

Venn’s Four Fundamental Pillars:

- Holistic, by capturing the large majority of cross-sectional and time-series risks for typical institutional portfolios.

- Parsimonious, by using as few factors as possible.

- Orthogonal, with each risk factor capturing a statistically uncorrelated risk across assets.

- Actionable, such that desired changes to factor exposure can be readily translated into asset allocation changes.

Stay tuned for our 4th piece on the last fundamental pillar of Venn.

Appendix

The authors referenced various sources for these institutional portfolio allocations. Those original source allocations can be found in the footnote of the table.

They then used their best judgment to consolidate and match source allocations with existing publicly available indexes. The results of that exercise are shown in the table below, detailing each portfolio's weight to different representative indexes.

To create the first chart displayed, each portfolio was created in Venn using the matching index and corresponding weight to represent each institutional investor type. These portfolios were rebalanced quarterly and analyzed in Venn’s risk decomposition module over the 5 years ending June 30, 2023. Venn breaks down each portfolio’s risk into common risk factors, but also reveals what percent of risk cannot be captured by our Two Sigma Factor Lens, also known as residual.

100% minus this residual gives us the percent of total risk that Venn’s Two Sigma Factor Lens is able to explain in these representative institutional portfolios. The percent of risk explained by Venn’s Two Sigma Factor Lens, or 100% minus the residual, was featured in the first chart.

Representative Institutional Portfolios

Sources: Public Pensions: “Investment”, NASRA, Endowments and Foundations: “NACUBO-TIAA Study of Endowments”, NACUBO (2021), Sovereign Wealth Funds: “Global Traditional Asset Allocation”, Statista Research Department (May 23, 2022), Family Office: “Global Family Office Report 2022”, UBS (2022), Insurers: “Capital Markets Special Report”, NAIC (2021).

References

1 This concept is similar to the statistical concept of R squared, which is the percent of variance of a dependent variable explained by explanatory variables

2 See appendix for details on construction

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Any statements regarding planned or future development efforts for our existing or new products or services are not intended to be a promise or guarantee of future availability of products, services, or features. Such statements merely reflect our current plans. They are not intended to indicate when or how particular features will be offered or at what price. These planned or future development efforts may change without notice. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

This article may include discussion of investing in virtual currencies. You should be aware that virtual currencies can have unique characteristics from other securities, securities transactions and financial transactions. Virtual currencies prices may be volatile, they may be difficult to price and their liquidity may be dispersed. Virtual currencies may be subject to certain cybersecurity and technology risks. Various intermediaries in the virtual currency markets may be unregulated, and the general regulatory landscape for virtual currencies is uncertain. The identity of virtual currency market participants may be opaque, which may increase the risk of market manipulation and fraud. Fees involved in trading virtual currencies may vary.

.png)