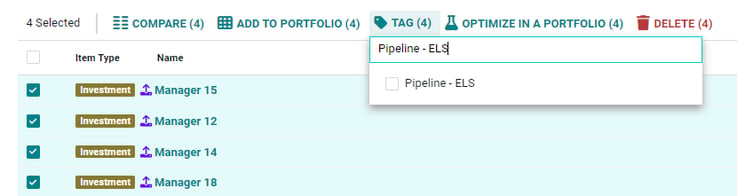

1. Tagging Investments

After uploading return streams or locating investments already on Venn’s Data Library, you can categorize them by applying a “Tag.” You can use this feature to label “Pipeline” investments that you’re currently performing diligence on, making it easier to access these tagged investments on the Library and perform additional analysis. Similarly, you can tag others as “Watch List” investments, perhaps due to poor performance, or simply use Tagging to better categorize all your uploads into their appropriate asset classes/strategies.

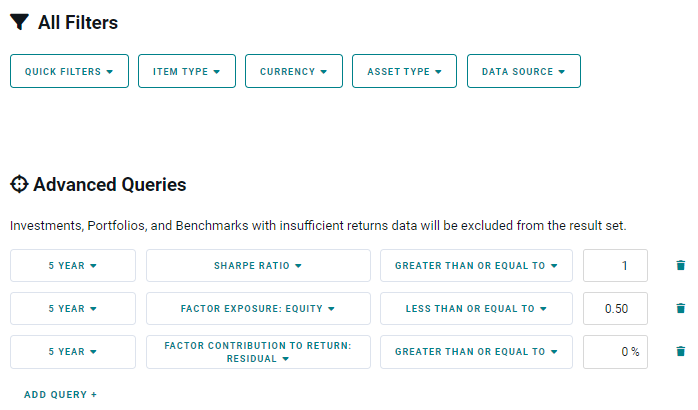

2. Advanced Search

In our Data Library, you can use Venn’s “All Filters and Queries” engine for advanced search exercises. For example, you can filter for investments that meet various performance and factor exposure criteria, such as those that have a:

- 5 Year Sharpe Ratio of greater than 1

- Beta to Venn’s Equity factor of less than 0.5

- and a Factor Contribution to Return from Residual of greater than 0.0%

This feature would allow you to quickly find potential additions to help fill gaps in your portfolios, increase diversification and improve the risk/return profile. You can also save and manage your common “searches” to revisit them at a later date.

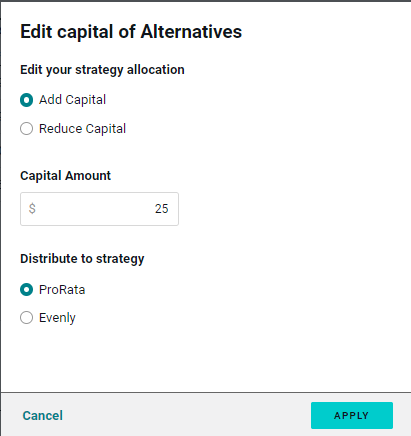

3. Edit Capital

Venn subscribers often get requests from their underlying clients to either add new capital to a portfolio or reduce capital in order to raise cash. To make this easier, we’ve added a feature called “Edit Capital” which allows you to easily “Add Capital” or “Reduce Capital” to all the investments within a portfolio, or just the investments within a sleeve of a portfolio. You can also choose to either “Evenly” distribute the amount across the investments, or on a "pro rata" basis, to maintain the percentage weights.

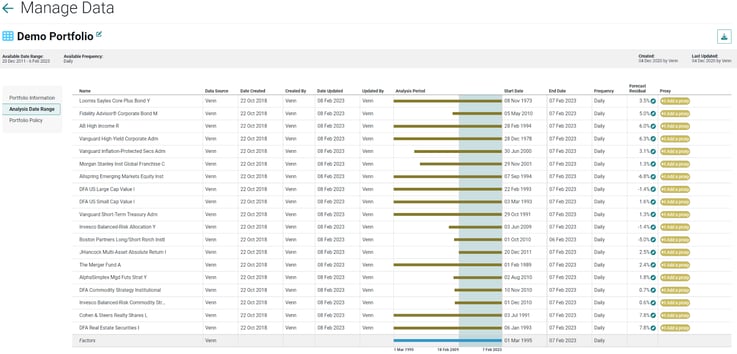

4. Manage Data for Portfolios

As portfolios can get quite complex, we’ve brought a backend tool to the forefront of Venn to help you see information pertaining to all the investments within your portfolios. Called the “Manage Data” page, you can get a bird's eye view of the available analysis periods for each line item, identify the source of each investment, and quickly add proxies if appropriate. Clients often use this to more deeply understand a portfolio and each of its constituents.

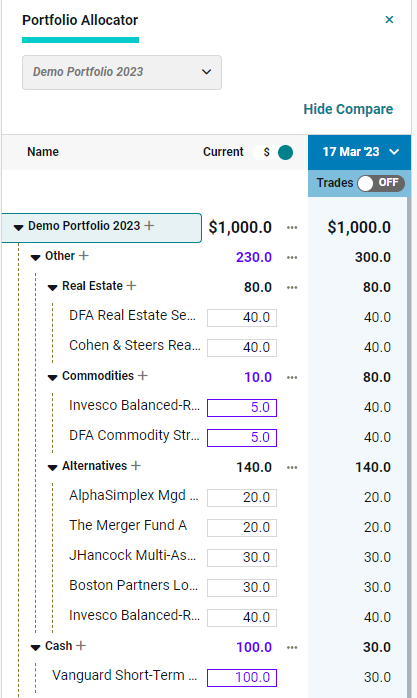

5. Compare a current portfolio to a historical version of itself

When viewing a portfolio on the Allocator Panel, you can easily compare that portfolio with an older version of itself. For example, say you just made some recent allocation changes by shifting weights and adding in a new fund. You can compare that new allocation to a historical version of that portfolio, before the changes were made, to see the impact. Simply click “Compare Versions,” select the older version, and see the portfolios side-by-side

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Any statements regarding planned or future development efforts for our existing or new products or services are not intended to be a promise or guarantee of future availability of products, services, or features. Such statements merely reflect our current plans. They are not intended to indicate when or how particular features will be offered or at what price. These planned or future development efforts may change without notice. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

This article may include discussion of investing in virtual currencies. You should be aware that virtual currencies can have unique characteristics from other securities, securities transactions and financial transactions. Virtual currencies prices may be volatile, they may be difficult to price and their liquidity may be dispersed. Virtual currencies may be subject to certain cybersecurity and technology risks. Various intermediaries in the virtual currency markets may be unregulated, and the general regulatory landscape for virtual currencies is uncertain. The identity of virtual currency market participants may be opaque, which may increase the risk of market manipulation and fraud. Fees involved in trading virtual currencies may vary.