As institutional investors evaluate crypto assets, how can they think about properly assessing their risks, especially in the context of a broader, multi-asset class portfolio?

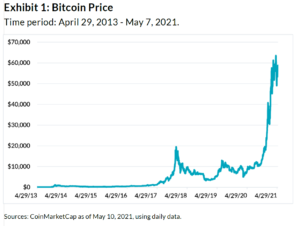

The chart below speaks volumes to the spectacular rise in cryptocurrency investing. Bitcoin has surged nearly 40,000%1 (that is not a typo) since April of 2013, for an annualized return of approximately 110%.2 It has not been a smooth ride—that return has come with an annualized volatility of 81%, but the risk-adjusted returns were still very attractive (Bitcoin’s annualized Sharpe ratio was ~1.3 over this period).

Bitcoin trading volumes have increased meaningfully during the pandemic. In January 2021, Cointelegraph reported that volume in the Bitcoin market doubled, smashing previous all-time records.3 In fact, Bitcoin’s five-day average daily trading volume as of April 18th was approximately $77B,4 roughly 70% of the NASDAQ’s five-day average volume.5

The incredible price appreciation (leading to bandwagon and “fear of missing out” effects), massive government stimulus, and people around the world spending more time at home and in front of screens have certainly contributed to Bitcoin’s meteoric rise, especially among retail investors. Increasingly, institutional investors are entering the crypto space, with managers like Skybridge,6 Blackrock,7 and Tudor8 announcing the addition of crypto to their investment universes or even the launch of crypto-dedicated funds. In fact, PWC estimates that crypto hedge fund assets increased 100% from $1 to $2 billion in 2019, and it seems like it’s only increasing from there.9

As institutional investors evaluate crypto assets, how can they think about properly assessing their risks, especially in the context of a broader, multi-asset class portfolio? In this Street View, we will seek to answer this question. We explore how traditional financial risk factor models can potentially explain the risk of the largest crypto asset, Bitcoin. We then seek to understand the extent to which there are influential, common risk drivers across crypto assets using a statistical technique called Principal Components Analysis.

Download the full PDF here.

References:

1As of May 10, 2021.

2The price data for Bitcoin was sourced from CoinMarketCap (as is the other crypto data in this Street View). The start date for their Bitcoin price data is April 29, 2013 as of May 10, 2021. Although Bitcoin’s long-term historical performance has been exceptional, the cryptocurrency has declined recently. As of this writing (June 2021), Bitcoin is recovering from a drawdown that began in mid-April 2021.

3https://cointelegraph.com/news/bitcoin-s-real-volume-doubles-previous-all-time-high

4Source: CoinMarketCap as of April 19, 2021.

5Source: https://www.cboe.com/us/equities/market_share/ as of April 19, 2021. The NASDAQ’s five-day average market “notional value” volume was approximately $109B.

6https://www.fundfire.com/c/3012053/377883/skybridge_launches_bitcoin_fund_crypto_assets_soar

7https://www.reuters.com/article/uk-blackrock-investment-crypto-currency-idUKKBN29Q0FT

The information contained in this article is provided for general informational and educational purposes only, and should not be construed as investment advice. The contributor to this material is associated with a client of Two Sigma Investor Solutions, LP (“TSIS”). Neither TSIS nor its affiliates have compensated the contributor for his statements. The statements from the interview have been edited and reformatted by TSIS with the contributor’s approval. Unless otherwise noted, the contributor’s statements do not represent the actual views or opinions of TSIS or its affiliates, or any officers, directors, or employees thereof.

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Any statements regarding planned or future development efforts for our existing or new products or services are not intended to be a promise or guarantee of future availability of products, services, or features. Such statements merely reflect our current plans. They are not intended to indicate when or how particular features will be offered or at what price. These planned or future development efforts may change without notice. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

This article may include discussion of investing in virtual currencies. You should be aware that virtual currencies can have unique characteristics from other securities, securities transactions and financial transactions. Virtual currencies prices may be volatile, they may be difficult to price and their liquidity may be dispersed. Virtual currencies may be subject to certain cybersecurity and technology risks. Various intermediaries in the virtual currency markets may be unregulated, and the general regulatory landscape for virtual currencies is uncertain. The identity of virtual currency market participants may be opaque, which may increase the risk of market manipulation and fraud. Fees involved in trading virtual currencies may vary.