Asset Owners

Asset owners use Venn to streamline asset allocation, evaluate investments, and manage risk and liquidity more efficiently.

Venn Use Cases

Venn can help asset owners streamline multi-asset portfolio analysis and improve allocation decision making. Our intuitive platform makes it easy to access returns-based insights and a risk factor framework.

Total Portfolio Analysis

Stress Testing and Scenario Analysis

Risk and Performance Attribution

Drawdown Monitoring

Private Asset Modeling

How Asset Owners Use Venn

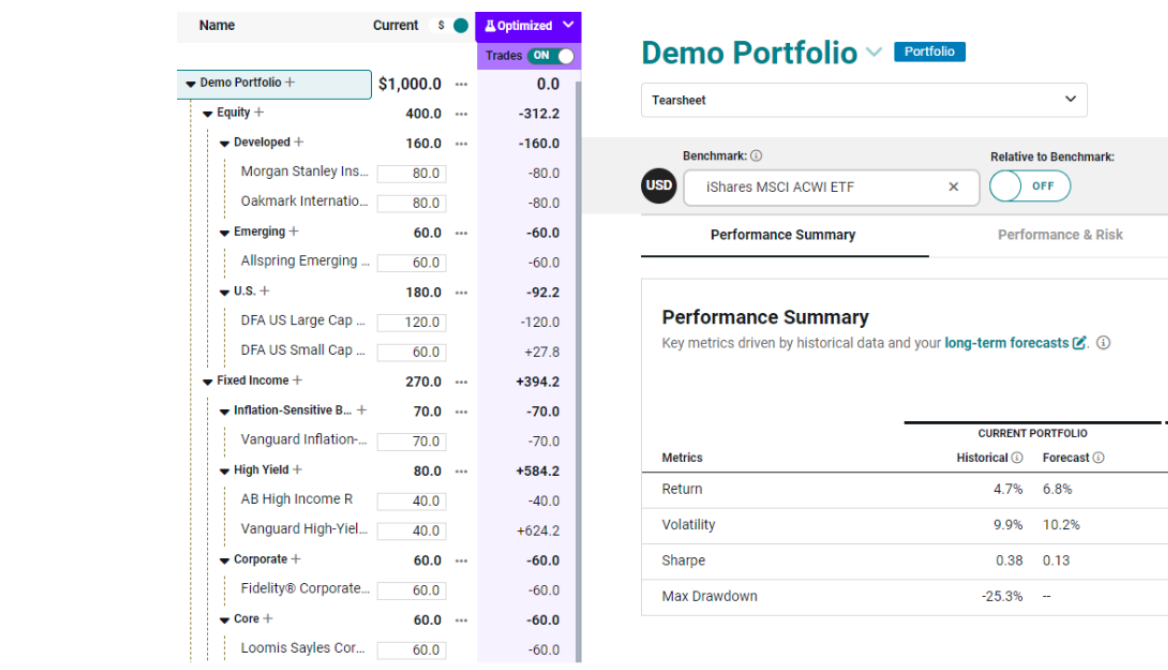

Asset Allocation

Change allocations on the fly to compare portfolios and manage risk across asset classes.

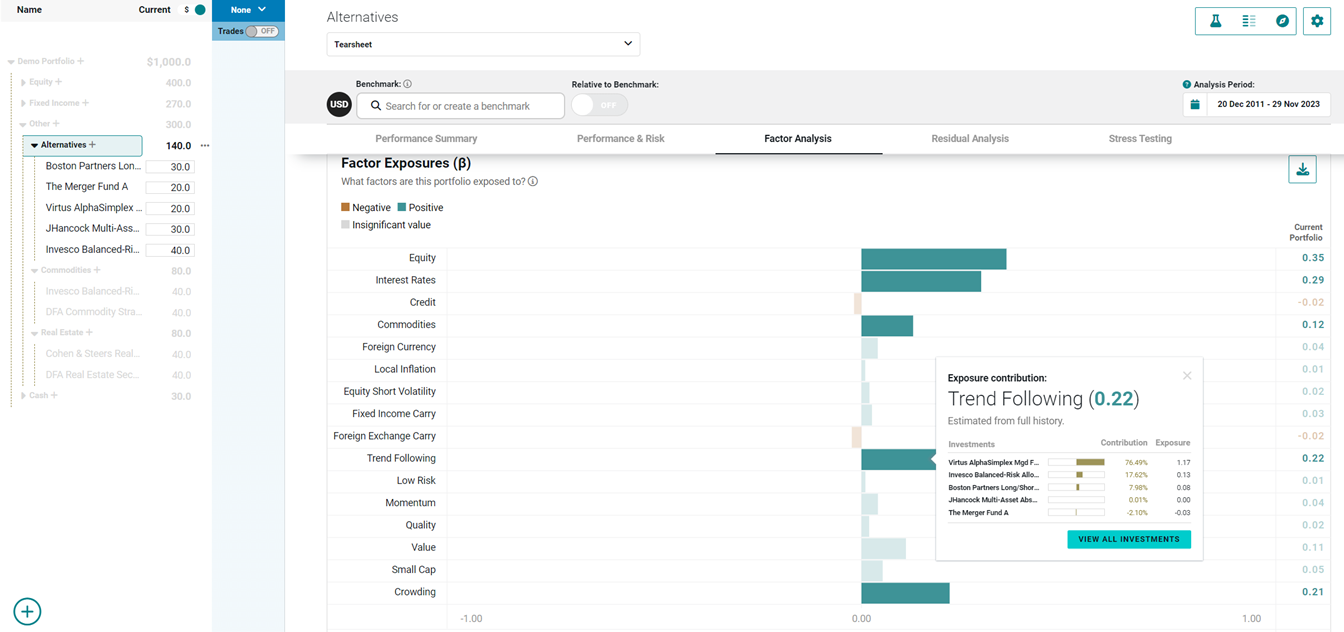

Manager Due Diligence

Decompose manager risk and return to identify those that help support performance goals and protect against drawdowns.

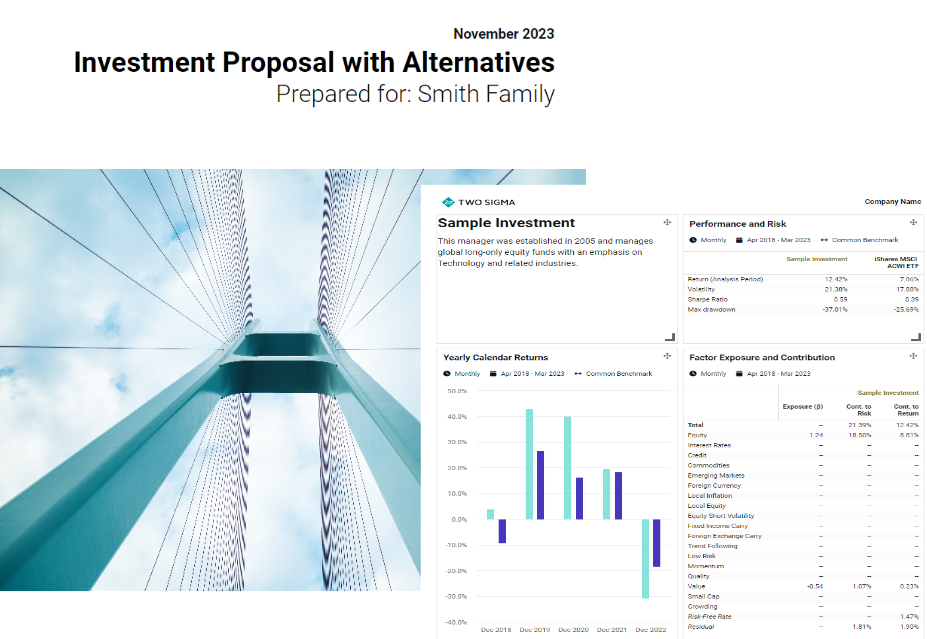

Internal and External Reporting

Streamline stakeholder reporting and quickly create polished reports and presentations.

Venn by the Numbers

250+

Clients

300,000+

Investments in Data Library

$25+ trillion

Client AUM

18

Factor Model

I have relied on Venn’s factor-based risk and return attribution tools to unearth critical insights that have helped shape some of the decisions we have been making since I joined. *

* The Venn subscriber featured here was not compensated for their statements. As a Venn subscriber, their use of portfolio analytics or other Venn features and their experience could differ from your organization’s due to their particular use of Venn, the version of Venn used, or other factors. Not all subscribers will be equally satisfied. The person providing this testimonial was selected based on a variety of factors, some of which are subjective. This document is for informational purposes only. Not an offer to buy or sell securities. Click here for Important Disclosure and Disclaimer Information.

A Conversation with Bola Olusanya - CIO of The Nature Conservancy

Naturally, ESG and impact investing are important elements of TNC’s investment philosophy.

Common Questions

What is the Venn connection to Two Sigma?

What goes into our Factor Model?

What is Private Asset Lab?

What is Report Lab?

Thought Leadership

Market, Industry, and Analytical Insights

Understanding Your Portfolio

Venn helps clients run portfolio analytics on anything with a return stream, from wine to private assets. And, add a dash of holdings data.

The Two Sigma Factor Lens

Asset allocators are increasingly leveraging risk factor analytics for manager due diligence and an elevated understanding of portfolio diversification.

The Bacon Factor

When comparing various items, you want to evaluate them on an even playing field from investments to bacon.